Banking on the US Hispanic Market

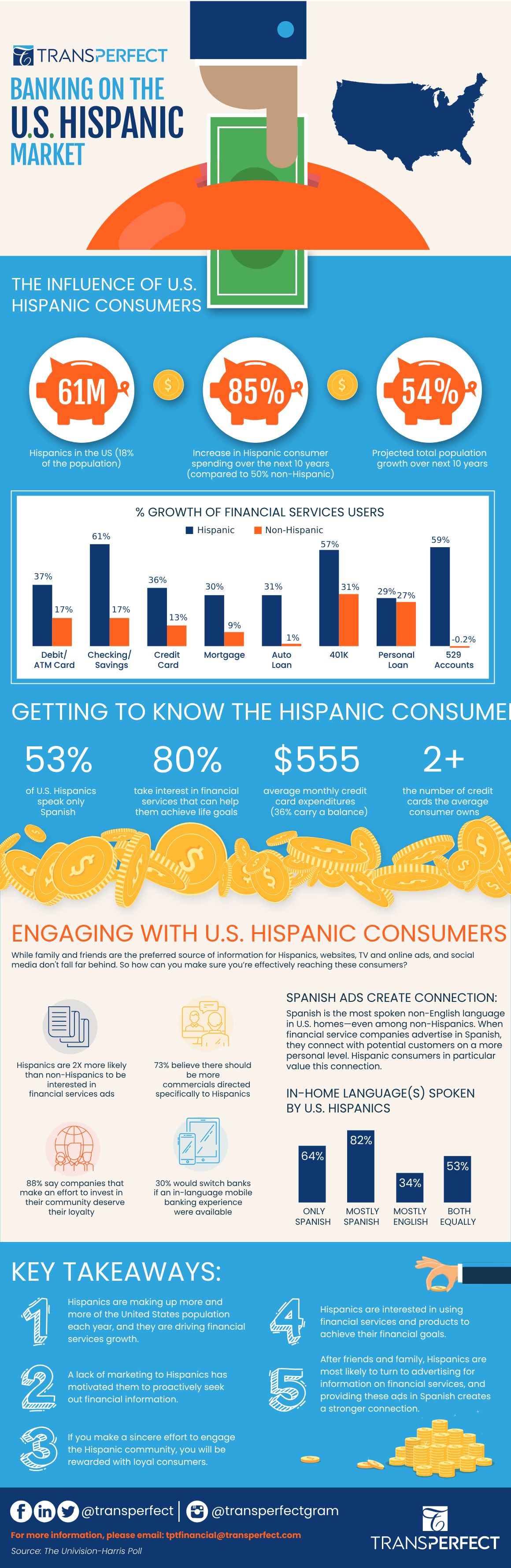

It’s not exactly a hard trivia question, “Other than English, what’s the most popular language in the United States?” Most people know that Spanish is America’s unofficial second language—about 61 million people across the country speak it as their primary language. This figure already represents about 18% of the total US population, and it is only expected to grow. In fact, according to the US Census Bureau, the number should increase by more than 50% over just the next ten years.

The reality is, the US Hispanic market is a driving force in our economy. And certain sectors, such as auto, clothing, technology, and healthcare are expected to see more growth from the Hispanic market than the non-Hispanic market over the next decade. Based on these projections, you would think that every community and regional bank across the country would be engaged in a fierce competition to bring Hispanic customers to their firm.

Among Hispanics, 80% are interested in learning how financial services and products can help them achieve their life goals. So where do they turn when they want to learn more? Since most banks don’t advertise in Spanish, a large number will go to family members for financial advice. In fact, 27% of Hispanics rate family and friends as their preferred source of financial information (higher than any other category). If you think about this from a language proficiency perspective, it’s a relatively safe assumption that when a bank signs a new Spanish-speaking customer, they don’t just win one person—they win the entire family. Trust is the most important quality that Hispanics look for in a financial institution, and the best way to build trust is to engage with them in native language.

So why doesn’t every bank advertise in Spanish? After all, on the surface, it seems like there is only upside. Pay an agency to develop some Spanish ads, sit back, and watch the new customers start rolling in. But then what? How do you service these new, Spanish-speaking customers?

The CFPB actually regulates this process, which deters many banks from even taking the first step. The Unfair, Deceptive, or Abusive Acts or Practices (UDAAP), which is a part of Dodd-Frank, prohibits financial institutions from advertising in languages other than English, if the firm cannot then offer 100% support in the same language.

Once a Spanish-speaking prospect becomes a Spanish-speaking customer, the bank then must offer everything in Spanish—including but not limited to the website, call center, applications, disclosures, and notices. So for any bank that wants to attract new, Spanish-speaking customers, they need to be ready to support every stage of the banking relationship, not just new customer acquisition. There are other concerns too—such as Fair Lending and the Community Reinvestment Act (CRA)—so before approving your marketing department’s new budget for Spanish ads, it’s best to bring in legal and compliance for preliminary discussions.

Some of the biggest banks in the country are already advertising and supporting customers in Spanish, but most still aren’t. In such a competitive environment, the rest of the industry won’t just sit back and watch a select few banks support the entire US Hispanic market. TransPerfect can help your firm advertise to and fully support Spanish-speaking customers, all while complying to the many industry regulations associated with doing so.

If you’re interested in learning more about TransPerfect’s banking solutions, please visit our website or email tptfinancial@transperfect.com.